QuantLib 金融计算——为 QuantLib 的 Python 接口添加自定义扩展

以 FR007 互换为例,演示如何为 QuantLib 的 Python 接口添加自定义扩展。

为 QuantLib 的 Python 接口添加自定义扩展——以 FR007 互换为例

现在将 QuantLibEx 中的自定义扩展和 QuantLib 源代码合并封装成一个 Python 接口。

首先,要为自定义扩展添加 swig 接口文件,详见这里。

其次,要修改 setup.py 文件,让 python 知道需要编译那些 .cpp 文件,详见这里。

剩下的工作和往常一样:

- 生成

.cpp文件:swig3.0 -c++ -python -outdir QuantLib -o QuantLib/ql_wrap.cpp quantlib.i - 编译 .cpp 文件:

CC=clang CXX=clang++ python3 setup.py build - 安装 Python 包装:

python3 setup.py install

作为测试,将 QuantLibEx 中的例子 ChinaFixingRepoSwapCurve 翻译成 python 代码。

1

2

3

4

5

6

7

8

9

10

11

12

13

14

15

16

17

18

19

20

21

22

23

24

25

26

27

28

29

30

31

32

33

34

35

36

37

38

39

40

41

42

43

44

45

46

47

48

49

50

51

52

53

54

55

56

57

58

59

60

61

62

63

64

65

66

67

68

69

70

71

72

73

74

75

76

77

78

79

80

81

82

83

84

85

86

87

88

89

90

91

92

93

94

95

96

97

98

99

100

101

102

103

104

105

106

107

108

109

110

111

112

113

114

115

116

117

118

119

120

121

122

123

124

125

126

127

128

129

130

131

132

133

134

135

136

137

138

139

140

141

142

143

144

145

146

147

148

149

150

151

152

153

154

155

156

157

158

159

160

161

162

163

164

165

166

167

168

169

170

171

172

173

174

175

176

177

178

179

180

181

182

183

184

185

186

187

import QuantLib as ql

import seaborn as sns

calendar = ql.China(ql.China.IB)

today = ql.Date(21, ql.January, 2020)

ql.Settings.instance().evaluationDate = today

delayDays = 1

settlementDate = calendar.advance(

today, delayDays, ql.Days)

# must be a business day

settlementDate = calendar.adjust(settlementDate)

print("Today: ", today)

print("Settlement date: ", settlementDate)

termStrcDayCounter = ql.Actual365Fixed()

dy7 = ql.Period(7, ql.Days)

mn1 = ql.Period(1, ql.Months)

mn3 = ql.Period(3, ql.Months)

mn6 = ql.Period(6, ql.Months)

mn9 = ql.Period(9, ql.Months)

yr1 = ql.Period(1, ql.Years)

yr2 = ql.Period(2, ql.Years)

yr3 = ql.Period(3, ql.Years)

yr4 = ql.Period(4, ql.Years)

yr5 = ql.Period(5, ql.Years)

yr7 = ql.Period(7, ql.Years)

yr10 = ql.Period(10, ql.Years)

d7Rate = ql.SimpleQuote(2.5900 / 100.0)

s1mRate = ql.SimpleQuote(2.5848 / 100.0)

s3mRate = ql.SimpleQuote(2.5713 / 100.0)

s6mRate = ql.SimpleQuote(2.5788 / 100.0)

s9mRate = ql.SimpleQuote(2.5925 / 100.0)

s1yRate = ql.SimpleQuote(2.6033 / 100.0)

s2yRate = ql.SimpleQuote(2.6665 / 100.0)

s3yRate = ql.SimpleQuote(2.7415 / 100.0)

s4yRate = ql.SimpleQuote(2.8288 / 100.0)

s5yRate = ql.SimpleQuote(2.9130 / 100.0)

s7yRate = ql.SimpleQuote(3.0466 / 100.0)

s10yRate = ql.SimpleQuote(3.1763 / 100.0)

d7RateHandle = ql.QuoteHandle(d7Rate)

s1mRateHandle = ql.QuoteHandle(s1mRate)

s3mRateHandle = ql.QuoteHandle(s3mRate)

s6mRateHandle = ql.QuoteHandle(s6mRate)

s9mRateHandle = ql.QuoteHandle(s9mRate)

s1yRateHandle = ql.QuoteHandle(s1yRate)

s2yRateHandle = ql.QuoteHandle(s2yRate)

s3yRateHandle = ql.QuoteHandle(s3yRate)

s4yRateHandle = ql.QuoteHandle(s4yRate)

s5yRateHandle = ql.QuoteHandle(s5yRate)

s7yRateHandle = ql.QuoteHandle(s7yRate)

s10yRateHandle = ql.QuoteHandle(s10yRate)

depositDayCounter = ql.Actual365Fixed()

d7 = ql.DepositRateHelper(

d7RateHandle, dy7, 0, calendar,

ql.Unadjusted, False, depositDayCounter)

fixedLegFreq = ql.Quarterly

fixedLegConv = ql.ModifiedFollowing

fixedLegDayCounter = ql.Actual365Fixed()

chinaFixingRepo = ql.ChinaFixingRepo(dy7, delayDays)

s1m = ql.ChinaFixingRepoSwapRateHelper(

delayDays, mn1,

s1mRateHandle, chinaFixingRepo, ql.YieldTermStructureHandle(), 0,

fixedLegConv, fixedLegFreq, calendar)

s3m = ql.ChinaFixingRepoSwapRateHelper(

delayDays, mn3,

s3mRateHandle, chinaFixingRepo, ql.YieldTermStructureHandle(), 0,

fixedLegConv, fixedLegFreq, calendar)

s6m = ql.ChinaFixingRepoSwapRateHelper(

delayDays, mn6,

s6mRateHandle, chinaFixingRepo, ql.YieldTermStructureHandle(), 0,

fixedLegConv, fixedLegFreq, calendar)

s9m = ql.ChinaFixingRepoSwapRateHelper(

delayDays, mn9,

s9mRateHandle, chinaFixingRepo, ql.YieldTermStructureHandle(), 0,

fixedLegConv, fixedLegFreq, calendar)

s1y = ql.ChinaFixingRepoSwapRateHelper(

delayDays, yr1,

s1yRateHandle, chinaFixingRepo, ql.YieldTermStructureHandle(), 0,

fixedLegConv, fixedLegFreq, calendar)

s2y = ql.ChinaFixingRepoSwapRateHelper(

delayDays, yr2,

s2yRateHandle, chinaFixingRepo, ql.YieldTermStructureHandle(), 0,

fixedLegConv, fixedLegFreq, calendar)

s3y = ql.ChinaFixingRepoSwapRateHelper(

delayDays, yr3,

s3yRateHandle, chinaFixingRepo, ql.YieldTermStructureHandle(), 0,

fixedLegConv, fixedLegFreq, calendar)

s4y = ql.ChinaFixingRepoSwapRateHelper(

delayDays, yr4,

s4yRateHandle, chinaFixingRepo, ql.YieldTermStructureHandle(), 0,

fixedLegConv, fixedLegFreq, calendar)

s5y = ql.ChinaFixingRepoSwapRateHelper(

delayDays, yr5,

s5yRateHandle, chinaFixingRepo, ql.YieldTermStructureHandle(), 0,

fixedLegConv, fixedLegFreq, calendar)

s7y = ql.ChinaFixingRepoSwapRateHelper(

delayDays, yr7,

s7yRateHandle, chinaFixingRepo, ql.YieldTermStructureHandle(), 0,

fixedLegConv, fixedLegFreq, calendar)

s10y = ql.ChinaFixingRepoSwapRateHelper(

delayDays, yr10,

s10yRateHandle, chinaFixingRepo, ql.YieldTermStructureHandle(), 0,

fixedLegConv, fixedLegFreq, calendar)

instruments = ql.RateHelperVector()

instruments.push_back(d7)

instruments.push_back(s1m)

instruments.push_back(s3m)

instruments.push_back(s6m)

instruments.push_back(s9m)

instruments.push_back(s1y)

instruments.push_back(s2y)

instruments.push_back(s3y)

instruments.push_back(s4y)

instruments.push_back(s5y)

instruments.push_back(s7y)

instruments.push_back(s10y)

termStrc = ql.PiecewiseBackwardFlatForward(

today,

instruments,

termStrcDayCounter)

curveNodeDate = calendar.adjust(settlementDate + dy7)

print(curveNodeDate - today, '{0:.8f}'.format(termStrc.discount(curveNodeDate)),

'{0:.7f}'.format(termStrc.zeroRate(curveNodeDate, termStrcDayCounter, ql.Continuous).rate() * 100.0))

curveNodeDate = calendar.adjust(settlementDate + mn1)

print(curveNodeDate - today, '{0:.8f}'.format(termStrc.discount(curveNodeDate)),

'{0:.7f}'.format(termStrc.zeroRate(curveNodeDate, termStrcDayCounter, ql.Continuous).rate() * 100.0))

curveNodeDate = calendar.adjust(settlementDate + mn3)

print(curveNodeDate - today, '{0:.8f}'.format(termStrc.discount(curveNodeDate)),

'{0:.7f}'.format(termStrc.zeroRate(curveNodeDate, termStrcDayCounter, ql.Continuous).rate() * 100.0))

curveNodeDate = calendar.adjust(settlementDate + mn6)

print(curveNodeDate - today, '{0:.8f}'.format(termStrc.discount(curveNodeDate)),

'{0:.7f}'.format(termStrc.zeroRate(curveNodeDate, termStrcDayCounter, ql.Continuous).rate() * 100.0))

curveNodeDate = calendar.adjust(settlementDate + mn9)

print(curveNodeDate - today, '{0:.8f}'.format(termStrc.discount(curveNodeDate)),

'{0:.7f}'.format(termStrc.zeroRate(curveNodeDate, termStrcDayCounter, ql.Continuous).rate() * 100.0))

curveNodeDate = calendar.adjust(settlementDate + yr1)

print(curveNodeDate - today, '{0:.8f}'.format(termStrc.discount(curveNodeDate)),

'{0:.7f}'.format(termStrc.zeroRate(curveNodeDate, termStrcDayCounter, ql.Continuous).rate() * 100.0))

curveNodeDate = calendar.adjust(settlementDate + yr2)

print(curveNodeDate - today, '{0:.8f}'.format(termStrc.discount(curveNodeDate)),

'{0:.7f}'.format(termStrc.zeroRate(curveNodeDate, termStrcDayCounter, ql.Continuous).rate() * 100.0))

curveNodeDate = calendar.adjust(settlementDate + yr3)

print(curveNodeDate - today, '{0:.8f}'.format(termStrc.discount(curveNodeDate)),

'{0:.7f}'.format(termStrc.zeroRate(curveNodeDate, termStrcDayCounter, ql.Continuous).rate() * 100.0))

curveNodeDate = calendar.adjust(settlementDate + yr4)

print(curveNodeDate - today, '{0:.8f}'.format(termStrc.discount(curveNodeDate)),

'{0:.7f}'.format(termStrc.zeroRate(curveNodeDate, termStrcDayCounter, ql.Continuous).rate() * 100.0))

curveNodeDate = calendar.adjust(settlementDate + yr5)

print(curveNodeDate - today, '{0:.8f}'.format(termStrc.discount(curveNodeDate)),

'{0:.7f}'.format(termStrc.zeroRate(curveNodeDate, termStrcDayCounter, ql.Continuous).rate() * 100.0))

curveNodeDate = calendar.adjust(settlementDate + yr7)

print(curveNodeDate - today, '{0:.8f}'.format(termStrc.discount(curveNodeDate)),

'{0:.7f}'.format(termStrc.zeroRate(curveNodeDate, termStrcDayCounter, ql.Continuous).rate() * 100.0))

curveNodeDate = calendar.adjust(settlementDate + yr10)

print(curveNodeDate - today, '{0:.8f}'.format(termStrc.discount(curveNodeDate)),

'{0:.7f}'.format(termStrc.zeroRate(curveNodeDate, termStrcDayCounter, ql.Continuous).rate() * 100.0))

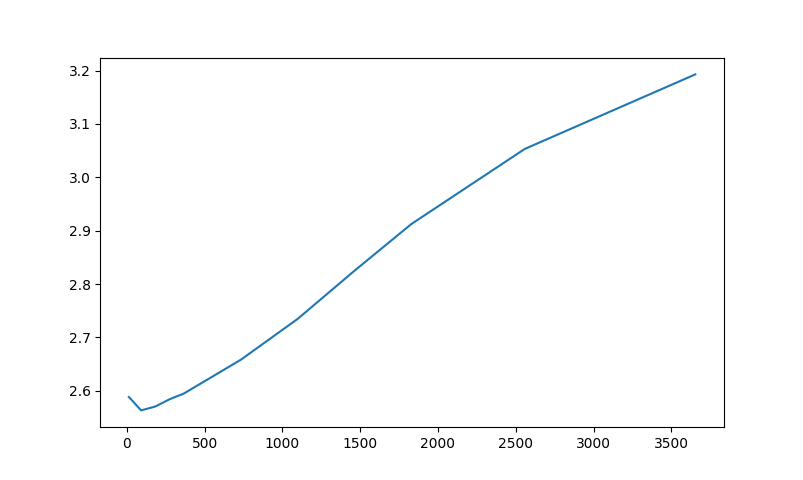

sns.lineplot(

x=[13, 34, 92, 183, 275, 367, 734, 1098, 1462, 1828, 2558, 3654],

y=[2.5884391, 2.5819802, 2.5633687, 2.570667, 2.5842461, 2.5950071,

2.6584605, 2.7347369, 2.8246057, 2.9122383, 3.0531303, 3.1927605])

结果和之前的完全一样。

1

2

3

4

5

6

7

8

9

10

11

12

13

14

Today: January 21st, 2020

Settlement date: January 22nd, 2020

13 0.99907852 2.5884391

34 0.99759776 2.5819802

92 0.99355973 2.5633687

183 0.98719415 2.5706670

275 0.98071798 2.5842461

367 0.97424520 2.5950071

734 0.94794334 2.6584605

1098 0.92102612 2.7347369

1462 0.89302652 2.8246057

1828 0.86428623 2.9122383

2558 0.80737256 3.0531303

3654 0.72642071 3.1927605

本文由作者按照 CC BY 4.0 进行授权